As Landlords ourselves we know how important it is to be able to rely on your Letting Agent to give you peace of mind in balancing rental profit with contented tenants. Sometimes being a middle-man is not an easy task. We try very hard to achieve customer satisfaction for both our landlords and our tenants. It is a tribute to our staff that we have such success in keeping everyone happy most of the time!

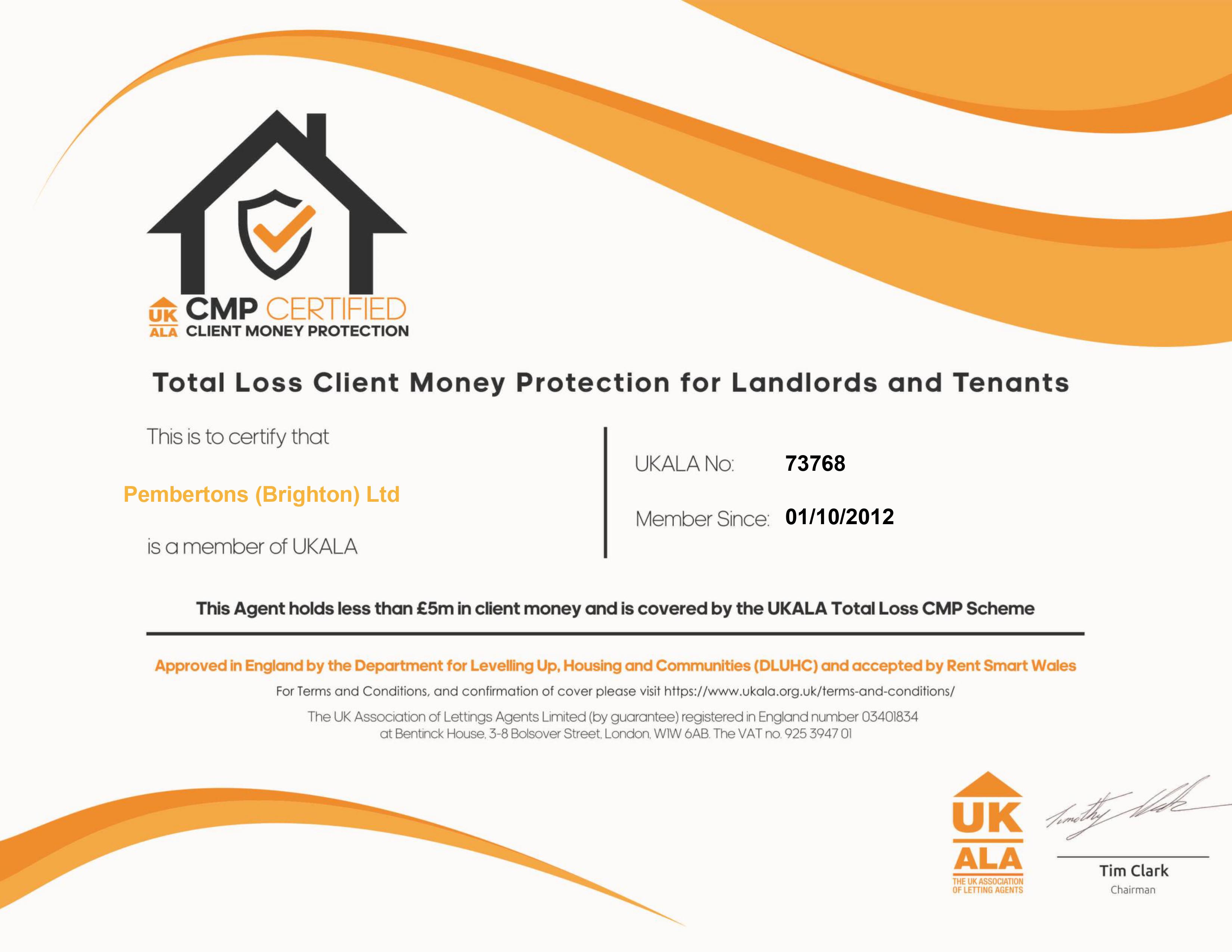

Pembertons is a member of UKALA (The UK Association of Letting Agents) which includes Total Loss Client Money Protection. We hold Professional Indemnity Insurance, and hold Clients’ funds in designated Client Money accounts with no right of set-off.

Pembertons is a member of the Property Redress Scheme and the NRLA.

Please call, or e-mail us, for more information and our fee structure:

We have three levels of service:

A. Tenant Introduction

Suitable for Landlords living locally who are experienced in letting legislation and the complexities of property management. Once Pembertons has acquired a satisfactory Tenant and completed the initial formalities the Landlord takes over for the duration of the Tenancy.

B. Rent Collection

Suitable for Landlords living locally and able to maintain their own property. The Tenant will contact the Landlord directly for all maintenance and general enquiries.

C. Full Management

Suitable for Landlords not living locally, unfamiliar with letting legislation and the complexities of property management. Pembertons will fully manage the tenancy.

COMMISSION RATES

Full Management : Set-up fee of 2 weeks rent plus 12.5% of gross rental income (plus vat)

Renewals charged at 1 week for fixed-term no-change renewals, or £50 for periodic renewals, (plus vat)

Letting & Rent Collection : Set-up fee of 2 weeks rent plus 10% of gross rental income (plus vat)

Renewals charged at 1 week for fixed-term no-change renewals, or £50 for periodic renewals, (plus vat)

Tenant Introduction Only: 1 month rent (plus vat)

NB: discounts are available depending on various factors including number of properties in portfolio, size of property, distance from our office, parking, decorative state, leasehold management company (if any)

VARIABLES: (inc vat)

Deposit registration : £included (with mydeposits)

£0 (if Landlord deposits with DPS)

UNFURNISHED PROPERTIES

Inventory check in / out :

Studio / 1 Bedroom : £72 / £102

2 Bedrooms : £84 / £114

3 Bedrooms : £114 / £144

4 Bedrooms : £126 / £156

5 Bedrooms : £144 / £174

6 Bedrooms : £180 / £210

7 Bedrooms : £198 / £228

Garage / shed / outbuilding / extra rooms : £12 / £12

FURNISHED PROPERTIES

Add £24 to all above fees

NB. Prices only valid for properties within 5 miles of our office

Standard Service Prices (inc vat)

Management charge on works more than £250 – 12% only with landlord’s authorisation

Gas Safety Certificate – £50-80 estimate (at cost)

Electrical Condition Report – POA – at cost

Key Cutting/testing admin charge – £12 plus cost of keys

Duplicate Monthly Financial Statement – £12

Yearly Financial Statement – £36

Min. fee in case of early termination by Landlord – £240

Placement fee (in case as above) – 1 months gross rent

Caretaking Service fee – £60 per visit

Supervision of building/major works charge – 18% of works charge

Provide court documents / evidence for Landlord – POA – min £240 (plus expenses)

Overseas telephone calls and faxes – At cost

Admin charge for mail forwarding – £7.20 plus cost of postage

Admin charge for cleaning at Landlords expense – £ 24 where Tenant not responsible

Waiting time charge per hour / extra property visit – £60

Admin charge for dealing with deposit disputes – £60 per hour

Important Safety Requirements

There are a number of legal responsibilities a Landlord has with regard to the safety of a rental Property.

We can advise you on all these safety regulations as outlined in Pembertons Agency Agreement with Landlords – Terms and Conditions.

Government Tenancy Deposit Scheme

The Landlord must by law register the Tenant Deposit with one of the government approved Tenant Deposit schemes within 14 days of the commencement of the tenancy. Pembertons belongs to the government approved scheme – Tenancy Deposit Solutions Ltd (www.mydeposits.co.uk)

GENERAL DATA PROTECTION REGULATION 2016

LANDLORDS

This notice explains what information we collect, when we collect it and how we use this. During the course of our activities, we will process personal data (which may be held on paper, electronically, or otherwise) about you and we recognise the need to treat it in an appropriate and lawful manner. The purpose of this notice is to make you aware of how we will handle your information.

Who are we?

PEMBERTONS (BRIGHTON) LTD (“we”or“us”) take the issue of security and data protection very seriously and strictly adhere to guidelines published in the General Data Protection Regulation (EU) 2016/679 which is applicable from the 25th May 2018, together with any domestic laws subsequently enacted.

We are notified as a Data Controller with the Office of the Information Commissioner under registration number Z1616353 and are the data controller of any personal data that you provide to us.

Our Data Protection Officer is Karina Pemberton, Director, Pembertons (Brighton) Ltd.

Any questions relating to this notice and our privacy practices should be sent to her at info@pembertons.co.uk.

How we collect information from you and what information we collect

Where we collect information about you:

● From your application for a Property Service (Managed, Letting & Rent Collection or Introduction)

● From your use of our property forms downloaded and completed

We collect the following information about you:

● Landlord name, e-mail address, telephone number, Date of Birth, address (including any previous addresses), marital status, National Insurance Number, nationality, next of kin,

● Property address, Freehold / Leasehold information, Ground Rent and Service charge information, Energy Performance Certificate, Council Tax banding, utility and service responsibilities, Managing Agent information;

● Your tax status, mortgage or Bank loan status, insurance details, contact details (including email, phone and fax numbers) of your accountant;

● Bank account details including account number and sort code,

Why we need this information about you and how it will be used

We need your information and will use your information:

● to undertake and perform our obligations and duties to you in accordance with the terms of our contract with you;

● to enable us to supply you with the services and information which you have requested;

● to help you to manage your tenancy;

● to carry out due diligence on any prospective landlord, including whether there is any money judgements against them, or any history of bankruptcy or insolvency;

● to analyse the information we collect so that we can administer, support and improve and develop our business and the services we offer;

● to contact you in order to send you details of any changes to our polices which may affect you; and

● for all other purposes consistent with the proper performance of our operations and business.

Sharing of Your Information

The information you provide to us will be treated by us as confidential and will be processed only by any third party, acting on our behalf, within the UK. We may disclose your information to other third parties who act for us for the purposes set out in this notice or for purposes approved by you, including the following:

● If we enter into a joint venture with or merge with another business entity, your information may be disclosed to our new business partners or owners;

● To carry out due diligence on you as a prospective landlord,

● If you are unable to make payments under your agreement with us, your information may be disclosed to any relevant party assisting in the recovery of any debt or the tracing of you as a landlord;

● In the creation, renewal or termination of the tenancy, your information will be disclosed to the relevant local authority, tenancy deposit scheme administrator, service/utility provider, freeholder, factor, facilities manager or any other relevant person or organisation in connection with this.

Unless required to do so by law, we will not otherwise share, sell or distribute any of the information you provide to us without your consent.

Transfers outside the UK and Europe

Your information will only be stored within the UK

Security

When you give us information we take steps to make sure that your personal information is kept secure and safe.

How long we will keep your information

We review our data retention periods regularly and will only hold your personal data for as long as is necessary for the relevant activity, or as required by law (we may be legally required to hold some types of information), or as set out in any relevant contract we have with you.

Your Rights

You have the right at any time to:

● ask for a copy of the information about you held by us in our records;

● require us to correct any inaccuracies in your information;

● make a request to us to delete what personal data of yours we hold; and

● object to receiving any marketing communications from us.

If you would like to exercise any of your rights above please contact us at info@pembertons.co.uk

Should you wish to complain about the use of your information, we would ask that you contact us to resolve this matter in the first instance. You also have the right to complain to the Information Commissioner’s Office in relation to our use of your information. The Information Commissioner’s contact details are noted below:

England:

Information Commissioner’s Office

Wycliffe House, Water Lane

Wilmslow, Cheshire, SK9 5AF

Telephone: 0303 123 1113

Email: casework@ico.org.uk

Scotland:

The Information Commissioner’s Office – Scotland

45 Melville Street, Edinburgh, EH3 7HL

Telephone: 0131 244 9001

Email: Scotland@ico.org.uk

Wales:

Information Commissioner’s Office

2nd floor, Churchill House

Churchill way, Cardiff, CF10 2HH

Telephone: 029 2067 8400

Email: wales@ico.org.uk

Northern Ireland:

Information Commissioner’s Office

3rd Floor, 14 Cromac Place

Belfast, BT7 2JB

Telephone: 028 9027 8757

Email:ni@ico.org.uk

The accuracy of your information is important to us – please help us keep our records updated by informing us of any changes to your email address and other contact details.

CLIENT MONEY HANDLING

Member Guidance

Members of UKALA are required to handle client money in

accordance with Appendix iii(4) of the UKALA scheme rules, and

with the UKALA Accounting Standard, which assists members’

compliance with industry best practice for holding and

accounting for client’s money. Links to these documents can be

found at the end of this factsheet.

Members are required by law to have their client money

handling procedures published on their business website.

Please be aware that UKALA reserve the right to reject any

membership application that we believe does not comply

with the principles below for holding client monies within the

businesses segregated client account(s).

What is Client Money?

Clients’ money is money that your business holds or has received

on behalf of a client, this can be deposited into a segregated client

account via Cash, Cheque, draft or electronic transfer. Please see

below examples of client’s money:

Tenants Deposits

Tenants Rent

Interest

Arbitration Fees

Service Charges

Fee money taken in advance

Client money held due to be paid by contractors

Sales proceeds

Money held by member appointed as receiver

UKALA require all members to hold client’s money in a segregated

ring-fenced client account that is authorised by the Financial

Conduct Authority (FCA). UKALA reserve the right to reject or cancel

a member’s application or renewal if the agent does not hold client’s

money in a segregated ring-fenced client account.

Member Guidance

info@ukala.org.uk

020 7820 7900

The UKALA scheme rules can be found at:

https://www.ukala.org.uk/terms-and-conditions/

The UKALA Accounting Standard can be found at:

https://www.ukala.org.uk/wp-content/uploads/2019/03/UKALAAccounting-

Standard-March-2019.pdf

Client money handling procedures

To comply with the law, agents taking client money must;

• Get a certificate confirming membership of the scheme you

join, and provide it to anyone who asks, free of charge.

You’ll need to display the certificate:

• In any office where you deal with the public

• On your website

To comply with requirements set by UKALA for handling of client

money an agent must:

1. Have set up a separate bank account for clients’ money;

2. Have the title of their Clients’ money bank account easily

distinguished from other accounts of their business;

3. Have in writing from their bank confirmation that all money is held

by the business as an agent;

4. Have the banks written confirmation that the bank is not entitled

to combine the clients’ money account(s) with any other account

or to exercise right of set-off or counterclaim against money in

that accounting respect of any sum owed to it or any other

account of the business;

5. Have and maintain systems and controls which enable you to

monitor and manage clients’ money transactions and any credit

risk arising;

6. Have accounting systems and client data securely controlled and

protected;

7. Obtain client’s written approval to make payments from their

account;

8. Bank all clients’ money at the earliest reasonable opportunity;

9. Nominate authorised staff to handle money

10. Ensure that records show any and all cash transactions

11. Reconcile client accounts together with bank and cash balances at

regular intervals in order to demonstrate control over the

accuracy and completeness of accounting records;

12. Ensure there are always sufficient funds in the account to pay al

amounts owing to clients; and

13. To pay amounts owing to clients as they fall due without delay.

Pembertons (Brighton) Ltd is a UKALA CMP certified company with Total Loss Client Money Protection for Landlords and Tenants with registration number 73768 valid until 01/10/2024